VIBE Gives Way to Live Business Identity

While VIBE has disappeared from the D&B website, it is still listed on the official USCIS website. Nonetheless, it has long since disappeared and has now been replace by Live Business Identity.

Fortunately, Live Business Identity is also a free option for applicants who need to establish the beneficial ownership of their countries. The USCIS still requires that submissions for visas such EB1-C or L1 validate the relationship between the parent foreign company and their US-based company. VIBE has been used to do this:

Validation Instrument for Business Enterprises (VIBE) is a tool designed to enhance USCIS’ adjudications of certain employment-based immigration petitions and applications.

Live Business Identity

According to Dun and Bradstreet, Live Business Identity helps ensure you have the most accurate and up-to-date view of organizations. The starting point of Live Business Identity is the Dun & Bradstreet D‑U‑N‑S® Number, a proprietary, unique nine-digit identifier for businesses that allows us to track a business and its related data and connections throughout the full life cycle of that business.

Like personal identities, which are much more than a fingerprint, Live Business Identity goes beyond D‑U‑N‑S to bring in additional valuable elements, such as the identification of connections between entities. Live Business Identity also provides many use-case-specific data elements about a company, including:

- Device identifiers and IP addresses for targeted digital marketing

Industry profiles for intelligent sales prospecting - Contact information for direct customer connection

- Extensive payment history for better predictability

- Entity ownership insights to know who ultimately benefits from a company’s performance.

- Predictive and prescriptive analytics and scores round out the insights Live Business Identity delivers.

Identifying beneficial ownership is a challenge. Examples of good governance provided by regulators often assume reasonably simplistic hierarchy structures and linkage, and a ‘best case scenario’ where information is readily available. However, this is not the case in the real world. In many regions, the beneficial ownership data that is available is simply not detailed enough, or is inconsistent, meaning it is hard to follow graphs or structures through to get the full picture.

Download DNB Onboard Applied Logic Fact Sheet Here

Benefits of Live Business Identity for USCIS Verification of Beneficiary Ownership

Comprehensive Data: Live Business Identity provides a 360-degree view of business entities, including information on beneficial ownership structures. This comprehensive data can help government agencies identify and verify the ultimate beneficial owners of companies.

Relationship Mapping: The system can identify hierarchies and beneficial ownership relationships between entities, allowing agencies to better understand complex ownership structures and detect potential risks.

Automated Processes: Live Business Identity enables the automation of verification processes, which can improve efficiency for government agencies tasked with reviewing beneficial ownership information.

Risk Identification: By providing deeper insights into customer, supplier, and partner relationships, the system can help agencies identify both opportunities and risks associated with beneficial ownership structures.

Data Enrichment: Government agencies can use Live Business Identity to enrich and validate the beneficial ownership information they receive from reporting companies, enhancing the accuracy and completeness of their records.

Compliance Support: While not explicitly mentioned in the search results, Live Business Identity's comprehensive data and relationship mapping capabilities could potentially assist agencies in ensuring compliance with beneficial ownership reporting requirements, such as those mandated by the Corporate Transparency Act.

Beneficial Ownership Information

In 2021, Congress passed the Corporate Transparency Act on a bipartisan basis. This law creates a new beneficial ownership information reporting requirement as part of the U.S. government’s efforts to make it harder for bad actors to hide or benefit from their ill-gotten gains through shell companies or other opaque ownership structures.

FinCEN's Beneficial Ownership Information is self-reported and its use by an agency like the USCIS is limited by its lack of validation.

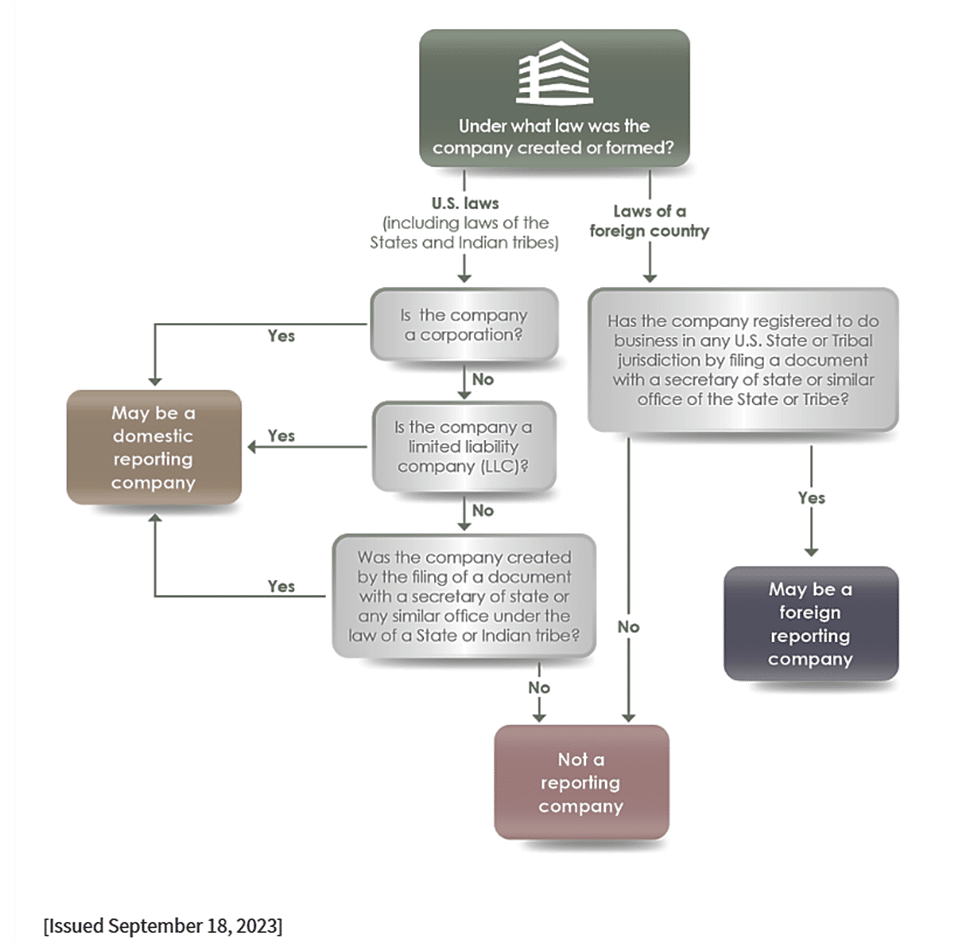

FinCEN’s Small Entity Compliance Guide for beneficial ownership information reporting includes the following flowchart to help identify if a company is a reporting company.

The rule identifies two types of reporting companies: domestic and foreign. A domestic reporting company is a corporation, limited liability company (LLC), or any entity created by the filing of a document with a secretary of state or any similar office under the law of a state or Indian tribe. A foreign reporting company is a corporation, LLC, or other entity formed under the law of a foreign country that is registered to do business in any state or tribal jurisdiction by the filing of a document with a secretary of state or any similar office. Under the rule, and in keeping with the CTA, twenty-three types of entities are exempt from the definition of “reporting company.”

FinCEN expects that these definitions mean that reporting companies will include (subject to the applicability of specific exemptions) limited liability partnerships, limited liability limited partnerships, business trusts, and most limited partnerships, in addition to corporations and LLCs, because such entities are generally created by a filing with a secretary of state or similar office.

Other types of legal entities, including certain trusts, are excluded from the definitions to the extent that they are not created by the filing of a document with a secretary of state or similar office. FinCEN recognizes that in many states the creation of most trusts typically does not involve the filing of such a formation document.

The Live Business Identity is the most logical choice for validating an enterprise for a visa application. Live Identify is far easier to navigate than was the VIBE system. Nonetheless, it can be confusing. We offer assistance with the process to all of our clients who are seeking visas requiring beneficial ownership validation for their submissions or for their RFEs.