EB5 Business Plans for Immigrant Investors

The upcoming year, 2022, will bring a paradigm shift in the economy and how we employ people. While these factors will profoundly affect the EB5 program, so will the sunset of the Regional Center Program and the landmark court case (download Behring Regional Center LLC v. Wolf, 20-cv-09263-JSC) that set aside the increase of investment amounts. EB5 business plans will be aligned with the new reality. What that means is that EB5 Direct Investment will be the watchword for 2022--and likely beyond. Now that TEAs (targeted employment areas) are determined as they were prior to 2019, that has also had an effect on the program. For a long time, we have created both regional center and direct investment immigration business plans so we are very familiar with direct investments.

We are focusing primarily on the direct investment plan, which can now be submitted with a TEA investment of $500,000. These Matter of Ho-compliant plans reflect the latest regulatory requirements as well as the most recent (2021/2022) market and demographic information. As the pandemic slowly evolves into an endemic situation, we are continuing our post-COVID analyses in all documents. This is a part of our due diligent approach.

Our investor-attractive, due diligent EB5 business plans have always been created according to USCIS guidelines, the most important of which is compliance with Matter of Ho requirements. Creating reasonable plans has been our hallmark. But there is now a new dimension to them that assures both the USCIS and the investor that a project is reasonable and justifiable in a post-COVID economy. Looking toward recovery and another evolution in EB5 requirements, we have created a new version of our EB5 business plan for a new reality.

The Impact of Behring Regional Center LLC v. Alejandro Mayorkas, et al: Another New EB5 Reality

Since 2019, stakeholders in the EB5 immigrant investor program had been dealing with changes in minimum investment amounts as well as changes in how TEAs were defined. Then came the Behring Regional Center LLC v. Alejandro Mayorkas, et al:

1. Minimum investment amounts are once again $500,000 for investments made into a TEA; and $1,000,000 for non-TEA investments.

2. TEA (targeted employment area) Designations are now obtained as they were prior to the EB-5 Immigrant Investor Program Modernization Final Rule (PDF). As of June 22, 2021, state labor departments are in charge of designating TEAs (under the Modernization Rule, the DHS held this responsibility). To obtain proof that their project is located in a TEA, EB-5 investors must request a TEA designation letter from the state labor department in question.

Before the Modernization Rule was overturned, the census tract in which an EB-5 project was located could be combined only with directly adjacent census tracts (tracts whose borders touched those of the EB-5 project’s tract). An EB-5 project’s census tract can now be combined with contiguous as well as directly adjacent tracts.

Note: To the extent that we can, we will help you obtain your TEA certification when we create your plan.

After filing an appeal in August 2021, the DHS was granted a motion to dismiss their appeal of the Behring Regional Center LLC v. Alejandro Mayorkas, et al decision on January 5, 2022.

Matter of Ho Compliance

Whatever else changes, the Matter of Ho requirements for a business plan will endure. Any business plan submitted with Form I-526 petition must be Matter of Ho compliant. The information presented regarding the location of the business and possible contingent locations must contain sufficient detail to meet Matter of Ho requirements. Learn more here about the EB5 Investor Classification...

We have helped clients obtain over $100,000,000 in funding in the last five years.

Post-COVID EB5 Business Plans

Why a Post-COVID Business Plan?

A post-COVID version of your business plan is critical right now because, quite simply, things have changed. An STR forecast for a hotel that was done at the end of 2019 is very likely no longer valid. STR realized this and began to change or qualify their forecasts. Used in a due diligent analysis, this revised information can help to create a reasonable forecast.

Still, this doesn't mean that the forecast will necessarily be bad for its duration. If your hotel is ready to open in as little as 18 months, the economy will hopefully have started to recover--and your forecast will reflect that.

Presenting a realistic forecast is not negative: Rather, it shows the USCIS and your investor that you have carefully evaluated your project and can show how it will succeed in a post-COVID economy.

Why You Need One of Our Post-COVID EB5 Business Plans

Our plans are based on a post-COVID portrait of the community and market into which your project will be introduced. Some highlights include:

- Each plan is a custom one and no part is software-generated

- Post-COVID demographics are current (2020/2025) so that you can present a realistic picture of population trends, the labor force (employment) and forecast changes

- Post-COVID five-year financials are transparent and based on local industry standards, accurately projecting how your enterprise will perform in your target market

- Post-COVID market analyses that take into account the impact of the pandemic on each industry and reflect performance in a recovered/recovering market

- Post-COVID analysis of the local or target market in which the enterprise will operate--as opposed to merely providing a national market overview

- Post-COVID analysis of the competition--the size of your target market and the players in it--which likely will have changed in some way

- Creation of an investor-attractive, USCIS-compliant plan is our focus.

We are the vanguard for compliant post-COVID EB5 Business Plans

Affordable pricing with plans starting at $1,750

EB5 Direct Investment Business Plans

This direct investment business plan meets and exceeds all of the USCIS requirements for such a plan. USCIS-approved methodologies for job calculation are used. In fact, the only substantial difference between this plan and one submitted through a regional center is the method of job calculation. The plan must be reasonable. Whether the plan is to be used to attract investors or to validate the investment of a lone immigrant petitioner into the business, it is created to the same high standard.

SELF PETITIONER SERVICES

Our NIW business plans are priced at 1,750. For that, we help you develop a concept that is in the national interest and then create the plan to substantiate it. We also offer additional services for the plan in the amount of $750, bringing the total to $2,500. For that, we help you assemble the documentation you need to make your submission as compliant as possible. Assembling this information can be a frustrating process. If you would like more information, contact us.

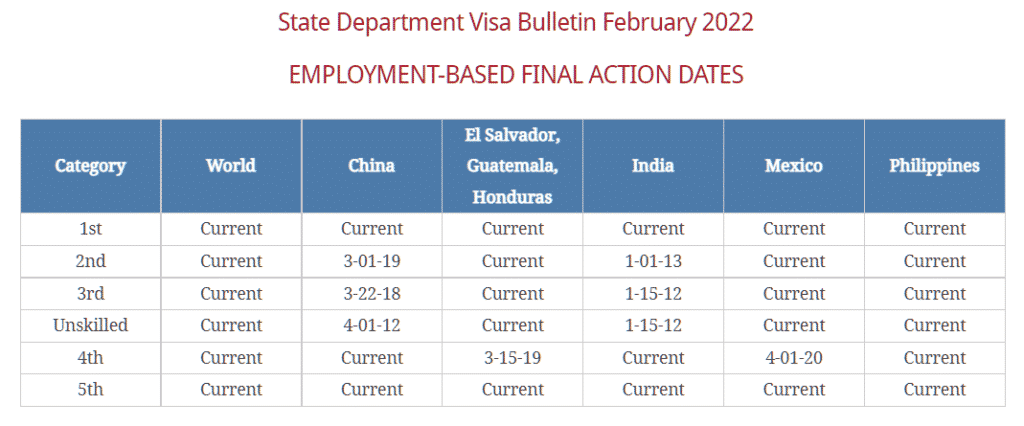

Employment-Based Final Action Dates, February 2022

The Non-Regional Center program will remain current for all countries. The Regional Center program expired in June 2021. It is listed as unavailable in the February 2022 Visa Bulletin Final Action Date chart. Should it be reauthorized, the Regional Center category will also be current for final action for all countries except EB5 China, which would have a November 22, 2015 final action date.

USCIS EB5 Resources

The EB5 Investor Classification

The EB5 Investor Classification (Chinese)

EB5 Immigrant Investor Program

EB5 Investors

EB5 Investors (Chinese)

We prepare RFE and NOID responses for all visa types--even if we did not participate in the original submission

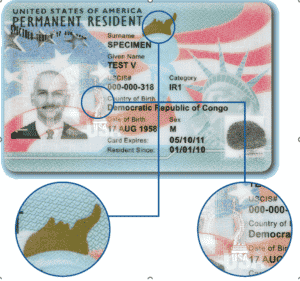

The custom artwork design incorporates the American flag, Statue of Liberty, and a predominantly green color palette on both sides of the card. The hand-drawn and computer-aided designs on both the front and back enhance the security and integrity of the card.

Optical variable inks will change color with the angle of observation or lighting. Optical variable images on both sides of the card are integrated into the overall artwork design, such as the stripes of the flag. The images vary with the angle of observation of lighting. Each card now has three transparent star-shaped windows of different sizes.

USCIS Case Status Online

Check the status of your case online with receipt number. The receipt number consists of three letters followed by 10 numbers. For example, the letters can be EAC, WAC, LIN, SRC, NBC, MSC or IOE. It is a very simple process. You can verify your case status online from your home or office, even from your cell phone!