EB5 Economic Studies

We have a long tradition of helping business owners plan new ventures by writing business plans and economic studies. Our work provides independent validation of client ideas that helps businesses grow. Each study contains the requisite target market analysis demonstrating demand and feasibility in that market arena. This, of course, is in addition to our job calculations, which are reasonable and based on justifiable information.

We have a long tradition of helping business owners plan new ventures by writing business plans and economic studies. Our work provides independent validation of client ideas that helps businesses grow. Each study contains the requisite target market analysis demonstrating demand and feasibility in that market arena. This, of course, is in addition to our job calculations, which are reasonable and based on justifiable information.

Economic Data

We used to calculate our job creation with IMPLAN data almost exclusively. In the last couple of years, however, the cost of IMPLAN data has increased exponentially. To the greatest extent possible, we would prefer not to pass this cost along to you. Because we cannot absorb this cost, we offer studies based on RIMS data from the Bureau of Economic Analysis. The quality of studies done with RIMS-based data is certainly equal to if not better than IMPLAN-based studies. It is the case that many economists have used RIMS for years.

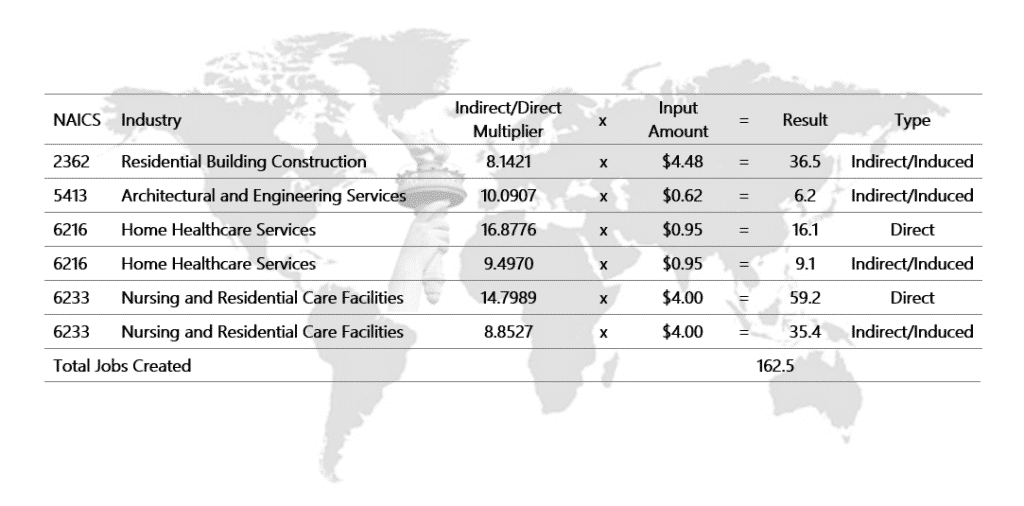

Multipliers

Both IMPLAN and RIMS II calculations are based on multipliers. Most EB5 economic models are input/output models based on multiplier tables. The way these models work is that for every unit of input, i.e. one employee or $1 million of construction expenditures or revenue, a certain number of jobs are predicted to be created. The number depends on the multiplier, which is calculated from vast sets of government data. For example, in a particular region, 11 jobs might be created as a result of $1 million of construction expenditures, or employing one person might create 0.9 indirect jobs.

Model Inputs

In projects that involve construction, construction expenditures are often the single most common input into EB5 economic models. The good news is that most developers are already in the practice of maintaining detailed expenditure records. The bad news is that they usually are not separating out eligible and ineligible costs for EB5 purposes, and the documentation is voluminous. Typically, successful I-829 packages can be more than 2,000 pages. It is possible to replace a large portion of this pile of documents with audited expenditure reports, but hiring an independent CPA firm to perform an audit is not inexpensive. Documentation includes, but is not limited to the following:

- Contracts, invoices, and paid checks;

- Full copies of all construction draw packages; and

- Detailed construction cost breakdowns that support the job calculations and the amount requested; we validate these figures by doing an RS Means analysis of them (The USCIS requires that a basis for these costs be validated by a source that verifies that these costs are reasonable).

Not all construction expense, however, is allowable. The reason we request detailed breakdowns of expenditures (or create them for you) is because we need to separate out allowable expense from that which is not allowed.

USCIS Commentary on Allowable Expense

In the Immigrant Investor Program, regional centers and immigrant investors must submit evidence of job creation as a result of investment in a new commercial enterprise. Immigrant investors must file a Form I-526 petition accompanied by evidence that the investment will directly or indirectly create full-time jobs for at least ten qualifying people.

Most regional centers and immigrant investors rely on multiplier tables (also known as input-output modeling) to estimate the number of jobs created. To obtain a valid result, the inputs must be eligible expenses for job creation purposes. Some types of expenses, such as transfers and transactions costs, are ineligible or limited in their job creation capabilities.

See 8 C.F.R. sections 204.6(m)(3)(ii), 204.6(j)(4)(iii) and 204.6(m)(3)(v).

Whether revenue for a job creating enterprise is projected or already accruing, it is one of the most common inputs into EB5 economic models. If revenue is an input for the model, a project must meet its revenue projections in order to create sufficient jobs. It is important to be conservative with revenue projections in the EB5 context; and, to always have a margin between the projected number of jobs and the number of jobs required to enable all investors to have the conditions on their residence removed. The revenue and expense projections must be verified as being reasonable and there must be a basis for the amounts. (This is required by the USCIS as well.)

All of our economic studies meet USCIS requirements for due diligent studies. Pricing begins at $1,200.

Ready to find out more?

Contact us today and tell us about your economic study project.