USCIS AI DETECTION

Over the last two years, the immigration world has quietly crossed a line: USCIS and the Department of State are no longer just reading your evidence; they are running it through artificial intelligence systems.

This affects every visa category—family-based, employment-based, humanitarian, temporary, and permanent. The AI tools are system-wide, analyzing documents across the entire adjudication process.

Learn More Here: How tech powers immigration enforcement

The Four AI Systems Behind the Curtain

But the risk profile is not uniform. Certain visa types—particularly those that rely heavily on business plans, financial projections, organizational documentation, fund source verification, and expert opinion letters—face significantly higher scrutiny when it comes to AI-detection concerns.

For immigration attorneys handling E-2, EB-5, L-1, EB-1A, O-1, or EB-2 NIW cases, this fundamentally changes how business plans and supporting evidence are perceived and evaluated.

This post explains, in practical terms, what USCIS is actually doing with AI, which visas and documents are most exposed, and how this should influence your expectations of any business plan writer or expert letter provider you work with.

USCIS and related agencies are already using four core AI systems in adjudication, enforcement, and fraud detection across all visa categories:

System 1: Evidence Classifier (USCIS)

A machine learning system that automatically categorizes and tags documents submitted with petitions. Instead of an officer sorting through a 400-page filing manually, Evidence Classifier groups and labels evidence so some documents are surfaced more prominently than others.

The Evidence Classifier acts as a "digital gatekeeper." For the best outcome, petitions must be organized in a way that is highly intuitive for both the AI, which first categorizes it, and the human officer, who eventually reviews it.

Practical application of the Classifier includes:

-

Disorganized, poorly labeled, or inconsistently presented evidence can be misunderstood or deprioritized.

-

A business plan (E-2, EB-5) or organizational chart (L-1) that doesn't clearly align with expected categories may not get the attention you assume it will.

-

Expert letters (EB-1A, O-1, EB-2 NIW) that don't follow standard formatting may be mis-categorized or buried.

System 2: StateChat (Department of State)

“We’re estimating the department is saving between, conservatively, 20 and 30,000 hours a week using some of these tools.” - John Silson, director of analytics at the U.S. Department of State’s Center for Analytics

A generative AI platform that helps consular officers interpret internal policy guidance, draft correspondence, and analyze cables and case patterns. For business and employment visas, this means consular officers can:

-

Quickly compare details across multiple E-2 or L-1 applicants in the same industry or from the same country

-

Spot patterns in business plans that suggest template reuse across different companies

-

Identify inconsistencies between what a client says at interview and what the business plan, organizational chart, or expert letter claims

System 3: ImmigrationOS (ICE)

A data aggregation and analytics platform that pulls information from Social Security, IRS, DMV, travel records, and more. It is used for compliance and enforcement, cross-checking what's in a petition against real-world records. For applicants, particularly those in complex or employer-sponsored categories, ImmigrationOS increases scrutiny on:

- Consistency Across Filings: Discrepancies between I-9 documents, tax records, payroll, and previous visa applications (DS-160) are more likely to be detected automatically.

- Material Changes: The system flags changes in job duties, salary, location, or corporate structure that were not properly updated via amended petitions.

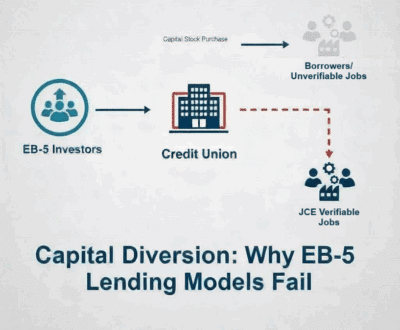

- Source of Funds: For investor visas (EB-5, E-2), it scrutinizes the alignment of financial histories and ownership records.

- Source of Funds: For investor visas (EB-5, E-2), it scrutinizes the alignment of financial histories and ownership records.

For business plans (E-2, EB-5, L-1), this creates a longer-term risk profile:

-

Unrealistic job creation projections and revenue forecasts can later be compared with actual payroll and tax filings

-

L-1 organizational structures can be verified against actual employment records and corporate tax returns

-

EB-5 investment capital deployment can be tracked against regional center reporting and job creation milestones

-

Inconsistent business activity post-approval may trigger follow-up scrutiny

- Operations inconsisent with RIA regulations.

System 4: FDNS-DS NexGen (USCIS Fraud Detection)

Operational since June 2023, FDNS-DS NexGen is the case management system used by USCIS's Fraud Detection and National Security (FDNS) Directorate to screen, track, and investigate immigration applications with suspected or confirmed fraud, public safety concerns, or national security threats.

What it does:

-

Uses machine learning entities from other USCIS applications to enhance investigative case prioritization

-

Detects duplicate casework and template reuse across different applications

-

Identifies individuals with multiple identities or fraudulent documentation patterns across petitions

-

Flags patterns suggesting unlawful fund sources, fabricated business projections, or credential fraud

-

Reduces investigative cycle time by automating pattern recognition—cases that would have taken weeks to flag now surface in days

Future planned enhancements:

USCIS plans to integrate AI/ML predictive modeling to identify fraud patterns before petitions are approved, working alongside human investigators to develop detection best practices.

Why this system matters specifically for investment visas:

Within FDNS is the National Security Screening Branch, which is specifically responsible for "vetting participants in the EB-5 program: i.e., investors, the sources of their funds, regional centers, and projects for national security threats."

For EB-5 cases, FDNS-DS NexGen cross-references multiple data sources to scrutinize:

-

Source of funds verification (the primary use case)

-

Are investment funds traced to legitimate, legal sources?

-

Do tax records, bank statements, and business documentation support claimed fund origins?

-

Are funds routed through jurisdictions flagged for money laundering or terrorist financing?

-

Does the investor's stated income history align with the investment amount?

-

Are there unexplained gaps in the documented path of funds?

USCIS requires investors to prove "by a preponderance of the evidence" that investment capital is lawfully sourced—both in the investor's home country and under U.S. law. This includes scrutinizing:

-

Employment income documentation (tax returns, employment contracts, pay stubs)

-

Asset liquidation records (real estate sales, stock sales, intellectual property sales)

-

Loan documentation (including verification that collateral was lawfully acquired)

-

Gift documentation (proving both that the gift was lawful AND that the gift-giver obtained funds lawfully)

-

Business proceeds (corporate tax returns, audited financials, profit distribution records)

FDNS runs this information through government databases including the Specially Designated Nationals (SDN) list, Specially Designated Global Terrorist (SDGT) list, and cross-checks against IRS records and international banking activity.

-

-

Business projection authenticity

-

Are financial forecasts realistic or fabricated to meet investment thresholds?

-

Do job creation metrics appear genuine or artificially inflated to satisfy the 10-job requirement?

-

Are market analyses based on verifiable data or generic industry templates?

-

-

Regional center and developer track records

-

Do project operators have histories of fraud, fund misuse, or failed job creation?

-

Are administrative fees and fund deployment consistent with project scope?

-

Have past projects delivered promised returns and immigration benefits?

-

For E-2 cases, FDNS-DS NexGen flags:

-

Template-driven business plans reused across multiple applicants (same language, structure, financial assumptions applied to different businesses)

-

Unrealistic substantial investment claims (investment amount disproportionate to total enterprise cost, or claimed at-risk capital that's actually secured)

-

Fraudulent market research or competitive analysis (fabricated statistics, non-existent competitor data, market size claims unsupported by sources)

-

Inconsistent narratives between business plan, supporting evidence, and interview statements

For L-1 cases, FDNS examines:

-

Organizational structure authenticity (does the claimed parent-subsidiary-affiliate relationship actually exist with genuine operational ties?)

-

Job duty misrepresentation (are described roles performed in reality, or are they inflated titles with minimal actual responsibilities?)

-

Specialized knowledge claims (is the "proprietary knowledge" genuine and company-specific, or is it general industry knowledge repackaged?)

-

Evidence of "shell company" structures created solely for visa purposes

The key point: these four systems don't "decide" cases, but they decide what gets flagged, what gets extra scrutiny, and which documents officers trust. FDNS-DS NexGen, in particular, can trigger months-long fraud investigations that result in RFEs, site visits, or outright denials if patterns suggest fraudulent activity.

What USCIS Officers Are Being Trained to Notice

Alongside these automated systems, officers are being trained to recognize AI-generated or AI-shaped content in core evidentiary documents.

The red flags they are taught to look for include:

-

Generic, formulaic language – Text that could apply to almost any petition in the same category, with minimal case-specific detail.

-

Internal inconsistencies – E-2 projections that contradict supporting financials; EB-5 fund source documentation with unexplained gaps; L-1 job descriptions that don't match organizational charts; EB-1A letters that claim familiarity with work but provide no specific examples.

-

Lack of concrete detail – Descriptions of market position (E-2/EB-5), fund origins (EB-5), intracompany relationships (L-1), or extraordinary achievements (EB-1A/O-1) that read like generic industry overviews rather than the applicant's actual circumstances.

-

Overly polished but "flat" narrative – A style that is grammatically flawless but strangely mechanical, without the natural rhythm and variation of human writing.

-

Unrealistic financials or claims – Growth curves with no relationship to local market economics (E-2/EB-5); job creation timelines that don't align with business stage; EB-5 fund sources that don't match investor's documented income history; EB-1A impact claims unsupported by citation data.

None of these are "AI crimes" by themselves. But when multiple red flags appear together, officers increasingly question the credibility of the document as a whole—and FDNS-DS NexGen may automatically flag the case for fraud investigation.

Visa Categories and Documents Under the Microscope

While AI touches all visa processing, certain categories face disproportionate scrutiny because of the types of evidence they require:

High-Risk: Investment and Business Development Visas

E-2 Treaty Investor

Business plans are central evidence. Generic, template-driven content and unrealistic financials are prime RFE triggers. Officers evaluate whether plans demonstrate substantial investment, marginality compliance, and genuine business viability. AI detection concerns focus on whether the plan reflects actual understanding of the business or reads like a template with names/numbers plugged in.

EB-5 Immigrant Investor (Highest Fraud Scrutiny)

FDNS designates EB-5 as a high-risk program requiring enhanced vetting. Beyond business plan quality, every EB-5 case undergoes source-of-funds verification through FDNS-DS NexGen, which cross-checks:

-

Tax returns against claimed income

-

Bank statements against documented fund transfers

-

Asset sales against ownership records

-

Gift or loan documentation against benefactor's financial capacity

-

International wire transfers against anti-money-laundering databases

Officers are specifically trained to look for:

-

Funds sourced from jurisdictions with weak financial transparency (China, Russia, certain Middle Eastern countries face enhanced scrutiny)

-

Complex fund paths with multiple intermediary accounts or offshore entities

-

Investment amounts inconsistent with investor's documented financial history

-

Administrative fee payments that appear structured to avoid banking reporting requirements

L-1 Intracompany Transferee

Business documentation, organizational charts, operational descriptions, and job duties face consistency checks across:

-

Prior visa filings (comparing L-1 petition to previous H-1B, if applicable)

-

Interview statements vs. written evidence

-

Actual corporate structure (verified via tax records, business registrations)

StateChat and Evidence Classifier can flag discrepancies when organizational narratives appear copy-pasted or when job descriptions don't align with realistic operational needs.

High-Risk: Extraordinary Ability and Expert-Driven Visas

EB-1A (Extraordinary Ability)

Expert opinion letters are under intense scrutiny. USCIS has documented patterns of "purchased endorsements" and template-driven testimonials. Officers are trained to assess whether letters demonstrate genuine familiarity with the beneficiary's work or read like AI-generated praise applicable to any researcher in the field.

O-1 (Extraordinary Ability in Arts/Sciences/Business/Athletics)

Similar to EB-1A—expert testimonials and peer letters must show specific, personalized assessment. Generic statements ("world-class expert," "groundbreaking work," "significant contributions") without concrete supporting examples trigger credibility concerns.

EB-2 NIW (National Interest Waiver)

Expert letters supporting "national importance" claims face detailed evaluation. Officers look for:

-

Concrete examples of how the beneficiary's work advances U.S. interests

-

Specific citations, collaborations, or real-world applications

-

Clear explanation of how the expert became familiar with the beneficiary's contributions

Template-driven letters that could apply to many researchers in the same field are increasingly challenged via RFE.

Why These Categories?

The pattern is clear: the more a visa category depends on narrative evidence, financial projections, fund source verification, organizational documentation, or expert assessments, the higher the AI-detection and fraud-screening risk.

Categories like H-1B (where LCAs and job descriptions are more standardized) or family-based petitions (where evidence is primarily documentary) face lower scrutiny for AI-generated content—though they're still processed through the same systems.

AI Detection Is Not Perfect – But It Doesn't Have to Be

AI "detectors" are far from perfect. They generate probabilities, not definitive labels, and they suffer from both false positives and false negatives. But in the immigration context, they don't need to be perfect to create problems.

If a business plan (E-2, EB-5, L-1):

-

Looks generic,

-

Reads like it was produced from a template,

-

Contains unrealistic numbers or inconsistent organizational claims,

-

Shows fund source documentation with unexplained gaps or suspicious patterns,

-

And triggers some AI-based linguistic patterns, you are asking an officer to do something very human: doubt.

Once credibility is in question—or once FDNS-DS NexGen flags a case for fraud investigation—the officer has wide discretion to:

-

Discount the evidentiary value of the plan or letter

-

Issue an RFE requesting additional, more specific proof (which in EB-5 cases can include forensic accounting of fund sources)

-

Refer the case to FDNS for site visits, interviews, or full fraud investigation

-

View the rest of the petition with heightened skepticism

-

Deny the petition if fraud indicators are substantiated

For EB-5 cases specifically, FDNS fraud investigations can take months or years, during which the petition remains in limbo and the investor's capital may be at risk in the project.

What This Means for Your Business Plan Writers, Fund Source Consultants, and Expert Letter Providers

If you are an immigration attorney, you are already accountable for everything filed under your name—even if you outsource business plan drafting, fund source documentation, or work with expert letter agencies.

In the AI and fraud-detection era, that means any writer, consultant, or provider you work with should be able to clearly answer four questions:

-

How do you use AI, if at all, in your drafting and research?

"We never use AI, ever" is increasingly unrealistic for research-intensive work. "We use AI, but won't tell you how" is risky for your ethical obligations. -

How do you ensure the plan or letter avoids generic, template-like language?

You want specific processes (human review stages, case-specific customization protocols), not vague assurances. -

How do you make sure the content is realistic and aligned with the specific circumstances of this case?

For E-2/EB-5: local market conditions, realistic financial assumptions.

For EB-5 specifically: fund source documentation that will withstand FDNS scrutiny, including forensic-level tracing.

For L-1: actual organizational structure, verifiable job duties.

For EB-1A/O-1/NIW: genuine expert familiarity with beneficiary's work, not generic praise. -

For EB-5 cases: Do you have experience with source-of-funds documentation that will pass FDNS review?

This is specialized work requiring understanding of:-

Anti-money-laundering compliance standards

-

International fund tracing and documentation

-

Tax record verification across jurisdictions

-

Forensic accounting principles

-

FDNS red flags and how to preempt them

Business plan writers who don't understand these requirements may produce plans that look professional but crumble under FDNS investigation when fund sources are questioned.

-

The Takeaway

USCIS is already using AI across all visa categories—and has deployed a specialized fraud detection system (FDNS-DS NexGen) that specifically targets investment visas like EB-5 for source-of-funds verification. The safest response is not to deny that reality, but to work with partners who:

-

Are transparent about their methodology

-

Understand what triggers FDNS scrutiny

-

Maintain disciplined quality control processes

-

Can document that strategic, legal, and case-specific content is human-authored and expert-reviewed

In upcoming posts, I'll walk through:

-

How to define an "AI-assisted" vs. "AI-generated" document in practical terms

-

What an optimal mix of AI and human work looks like for immigration business plans

-

And why the quality of AI output depends entirely on the expertise of the person prompting it

For now, the takeaway is simple:

USCIS is already using AI and fraud detection systems. Your service providers' methodologies must account for that reality.

AI and Immigration Visa Business Plans

Our AI Use in Immigration Business Plans – In Plain English

To help attorneys navigate this new landscape, I've published an AI Transparency Charter that explains exactly:

Where I use AI (research, benchmarking, consistency checks)

Where I don't (strategic analysis, legal positioning, expert letters, fund source forensics)

How I support you if USCIS or FDNS ever questions authorship or fund documentation

Whether you handle E-2, EB-5, L-1, EB-1A, O-1, or EB-2 NIW cases, the framework applies. For EB-5 specifically, I can walk you through how fund source documentation is structured to withstand FDNS scrutiny.

If you'd like to review it or adapt the language for your own internal AI policy, I'm happy to share it.

find out more

Get in touch and find out more about us and our use of AI